Reverse Percentages – GCSE Maths

Reverse Percentage also known as “Reverse Percent“ is a mathematical operation that involves finding the original value or quantity from which a percentage was calculated.

What are Reverse Percentages?

- Reverse percentage is a mathematical concept which is used to find or determine the original value before the Percentage Increase or Decrease.

- Start with the final amount after a percentage change and work backward to find the original number.

- If you know the final value after a percentage change, reverse percentages help you find the original value before the change.

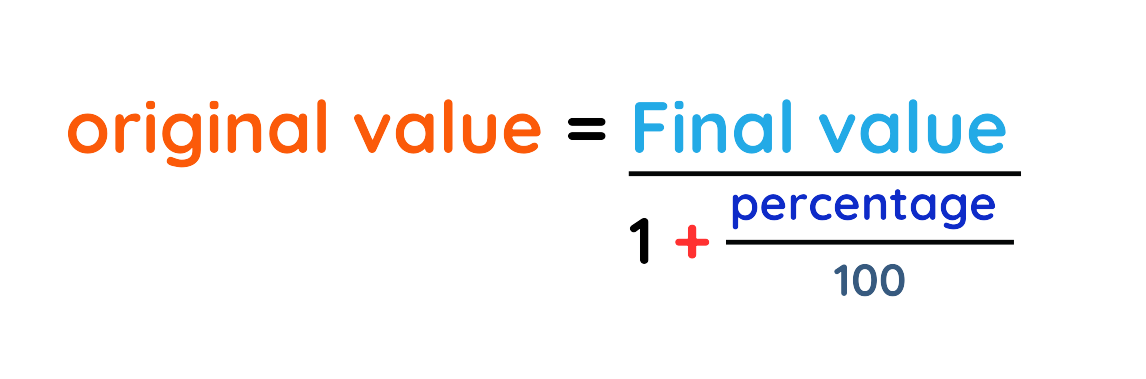

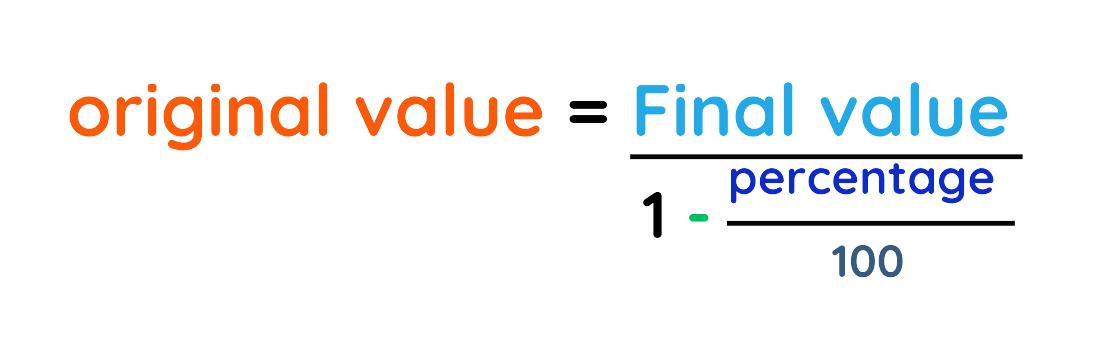

Formula used in Reverse Percentages:

Solved Example

Solved Example

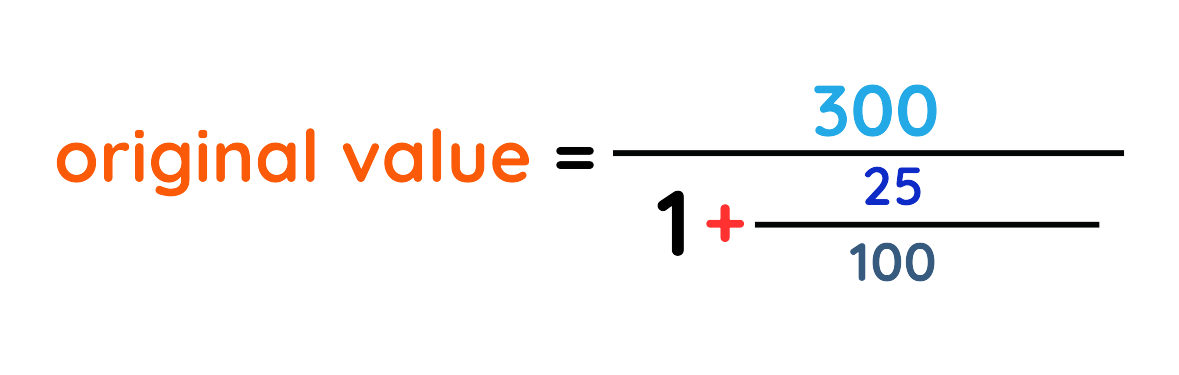

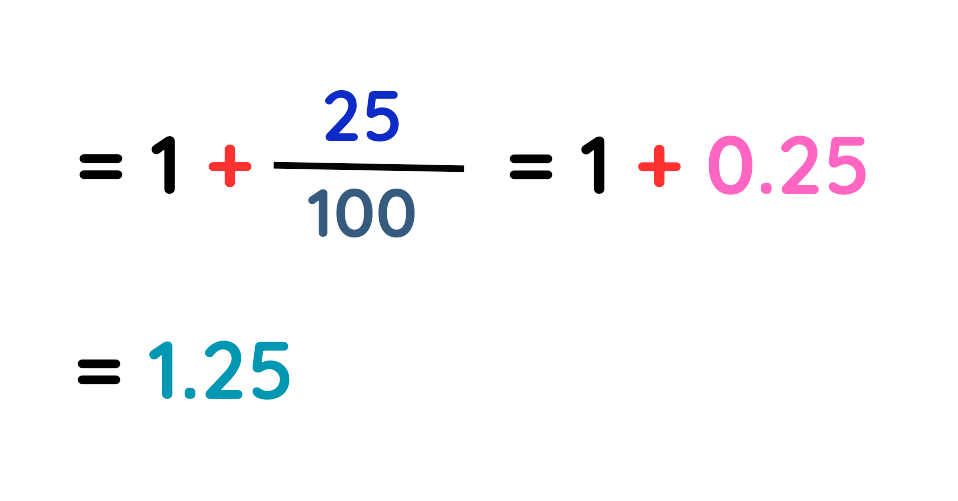

Problem: A TV now costs £300 after a 25% increase. What was its original price?

Solution:

Step #1: Given:

- New value = £300

- Percentage increased = 25%

Step #2: Applying the formula:

Step #3: Put the values in formula:

Step #4: Simplify the denominator:

Step #5: The final value is:

The original price of TV was £240.

Final Answer: £240

How Reverse Percentage is Different From Original Percentage?

Original Percentages:

- It is use when we know the original number or value and want to calculate a percentage of it.

- If original price of shirt is £100 then after 20% increase, the new price will be £120.

Reverse Percentages:

- It is use when we know the final value after a percentage change and want to find the original value.

- After a 20 % increase, the new price of a shirt is £120 then the original price of a shirt was £100.

Steps to Solve Reverse Percentages

Step#1: Understand the Question

- Check the new value is increased or decreased after the change of original value:

- If the final value is after a percentage increase, the formula is:

- If the final value is after a percentage decrease, the formula is:

Step#2: Work out what percentage you now have.

Step#3: Solve the equation

- We know the original equivalent percentage for all the process is 100%.

- Use this to find the 1% of original price or value.

Step#4: Now multiply the 1% with 100% to get the original value or price.

Note: To solve this easily, we should also know the concept of Original Percentages.

Three Additional Solved Examples

Solved Example 1

Solved Example 1

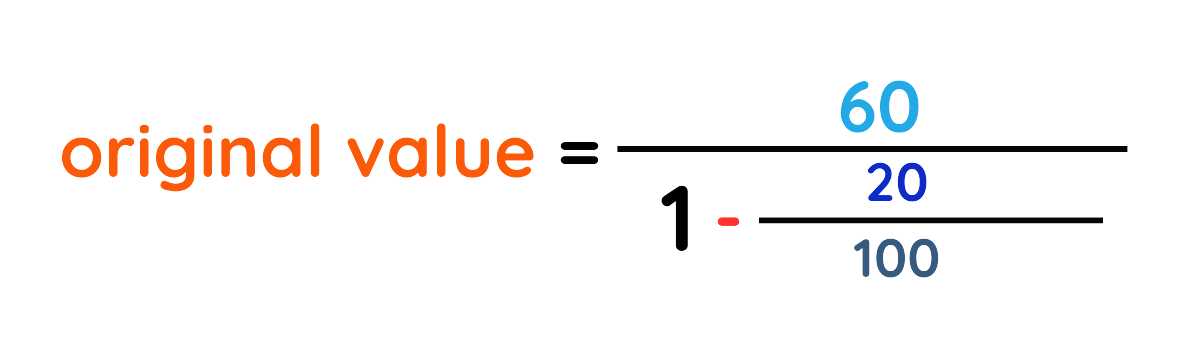

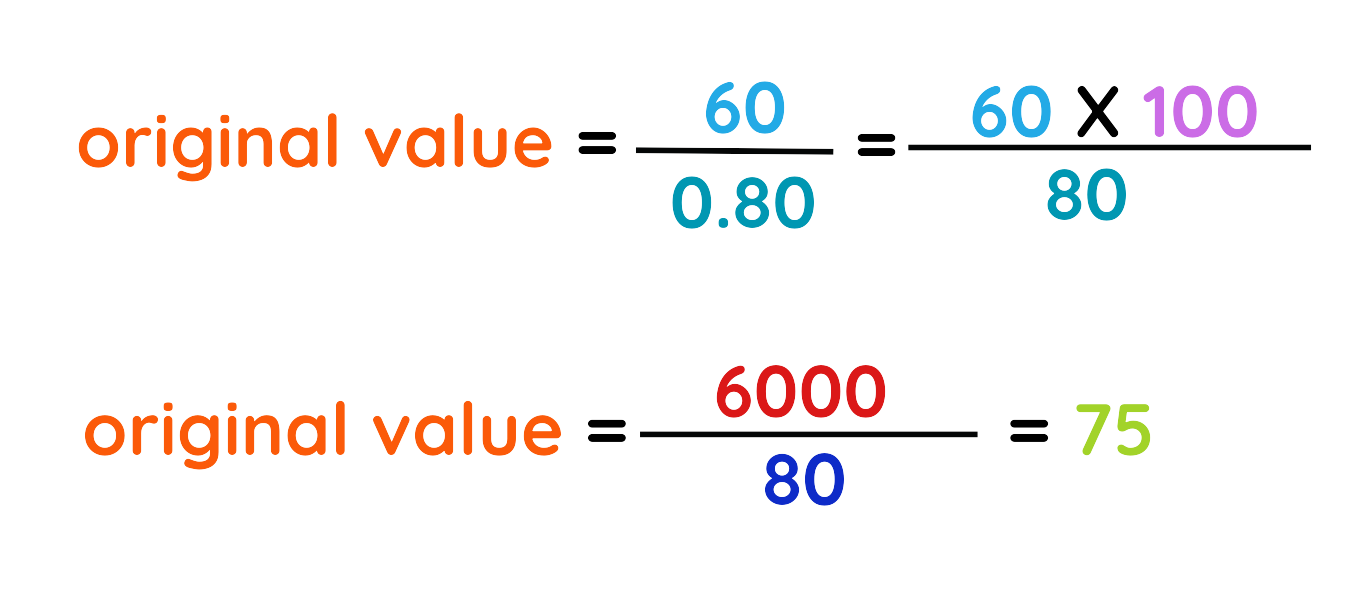

Problem: A jacket costs £60 after a 20% discount. What was the original price?

Solution:

Step #1: Given:

- New value = £60

- Percentage increased = 20%

Step #2: Applying the formula:

Step #3: Put the values in formula:

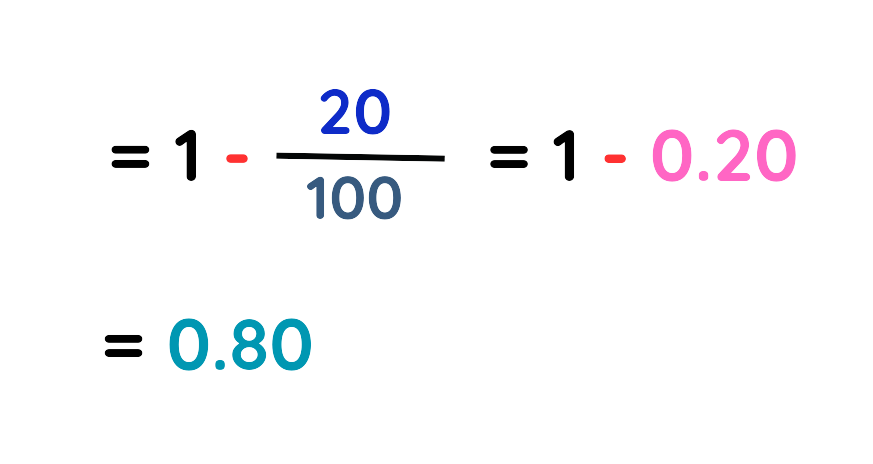

Step #4: Simplify the denominator:

Step #5: The final value is:

The original price of jacket was £75.

Final Answer: £75

Solved Example 2

Solved Example 2

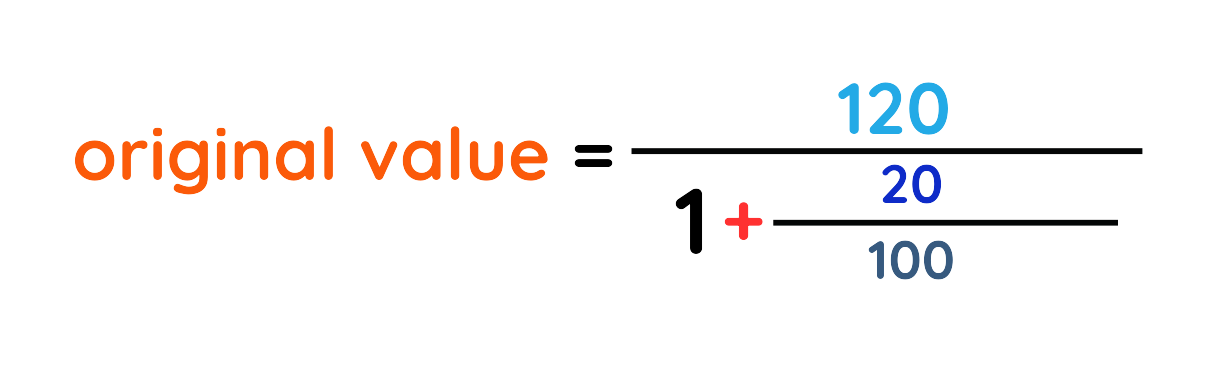

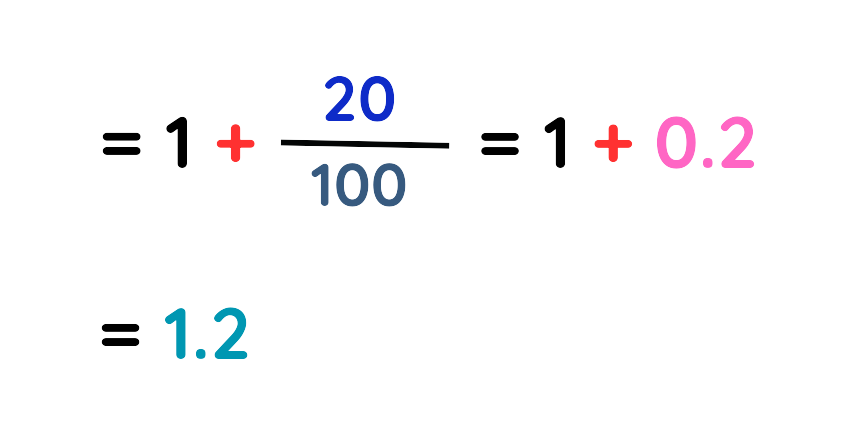

Problem: A product costs £120 including 20% VAT. What was the price before tax?

Solution:

Step #1: Given:

- New value = £120

- Percentage increased = 20%

Step #2: Applying the formula:

Step #3: Put the values in formula:

Step #4: Simplify the denominator:

Step #5: The final value is:

The original price of product was £100.

Final Answer: £100

Solved Example 3

Solved Example 3

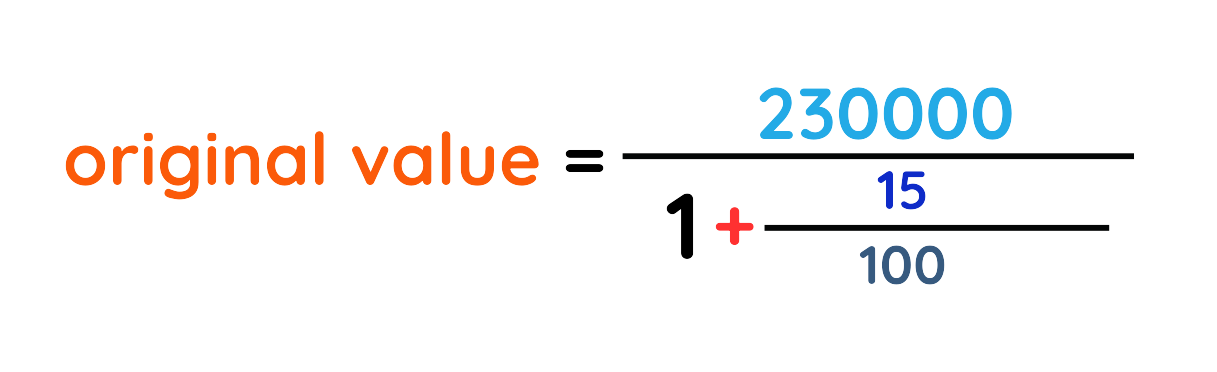

Problem: A house increased in value by 15% and is now worth £230,000. What was its original price?

Solution:

Step #1: Given:

- New value = £230,000

- Percentage increased = 15%

Step #2: Applying the formula:

Step #3: Put the values in formula:

Step #4: Simplify the denominator:

Step #5: The final value is:

The original price of house was £200,000.

Final Answer: £200,000

Practice Questions and Answers on Reverse Percentages

Question 1: A shirt is on sale for £60 after a 20% discount. What was the original price?

Question 2: After a 15% increase, the price of a phone is £345. What was the original price?

Question 3: A house is now valued at £110,000 after a 10% decrease. What was the original price?

Question 4: The price of a book is £25 after a 30% increase. What was the original price?

Question 5: A laptop is now £850 after a 25% discount. What was the original price?

Question 6: A company’s revenue is £1,27,500after a 12.5% decrease due to economic downturn. What was the original revenue before the decrease?

Question 7: A car’s price increased by 18% and is now valued at £4,720. What was the original price before the increase?

Question 8: A company reduced its workforce by 22%, leaving 4,290 employees. How many employees did the company originally have?

Question 9: The price of gold increased by 27%, and the new price is £1,397 per ounce. What was the original price?

Question 10: A business made £315,800 in profit after a 19.5% loss compared to the previous year. What was the previous year’s profit?

Solutions

Question 1:

Solution:

Step#1: Given

• New value = £60

• Percentage decreased = 20%

Step#2: Applying the formula

Original Value = Final Value ÷ (1 ± Percentage ÷ 100)

Step#3: Put the values in the formula

Original Value = 60 ÷ (1 − 20 ÷ 100)

Step#4: Simplify the denominator

= 1 − 20 ÷ 100 = 1 − 0.2

= 0.8

Step#5: The final value is

Original Value = 60 ÷ 0.8

= 60 × 10 ÷ 8

= 600 ÷ 8 = 75

The original price of the shirt was £75

Question 2:

Solution:

Step#1: Given

• New value = £345

• Percentage increased = 15%

Step#2: Applying the formula

Original Value = Final Value ÷ (1 ± Percentage ÷ 100)

Step#3: Put the values in the formula

Original Value = 345 ÷ (1 + 15 ÷ 100)

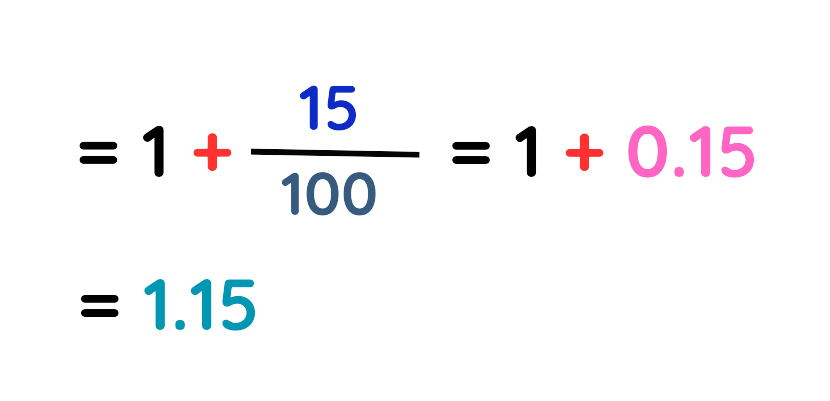

Step#4: Simplify the denominator

= 1 + 15 ÷ 100 = 1 + 0.15

= 1.15

Step#5: The final value is

Original Value = 345 ÷ 1.15

= 345 × 100 ÷ 115

= 34500 ÷ 115 = 300

The original price of the phone was £300

Question 3:

Solution:

Step#1: Given

• New value = £110,000

• Percentage decreased = 10%

Step#2: Applying the formula

Original Value = Final Value ÷ (1 ± Percentage ÷ 100)

Step#3: Put the values in the formula

Original Value = 110000 ÷ (1 − 10 ÷ 100)

Step#4: Simplify the denominator

= 1 − 10 ÷ 100 = 1 − 0.1

= 0.9

Step#5: The final value is

Original Value = 110000 ÷ 0.9

= 110000 × 10 ÷ 9

= 1100000 ÷ 9 = 122222.22

The original price of the house was £122,222.22

Question 4:

Solution:

Step#1: Given

• New value = £25

• Percentage increased = 30%

Step#2: Applying the formula

Original Value = Final Value ÷ (1 ± Percentage ÷ 100)

Step#3: Put the values in the formula

Original Value = 25 ÷ (1 + 30 ÷ 100)

Step#4: Simplify the denominator

= 1 + 30 ÷ 100 = 1 + 0.3

= 1.3

Step#5: The final value is

Original Value = 25 ÷ 1.3

= 25 × 10 ÷ 13

= 250 ÷ 13 = 19.23

The original price of the book was £19.23

Question 5:

Solution:

Step#1: Given

• New value = £850

• Percentage decreased = 25%

Step#2: Applying the formula

Original Value = Final Value ÷ (1 ± Percentage ÷ 100)

Step#3: Put the values in the formula

Original Value = 850 ÷ (1 − 25 ÷ 100)

Step#4: Simplify the denominator

= 1 − 25 ÷ 100 = 1 − 0.25

= 0.75

Step#5: The final value is

Original Value = 850 ÷ 0.75

= 850 × 100 ÷ 75

= 85000 ÷ 75 = 1133.33

The original price of the laptop was £1133.33

Question 6:

Solution:

Step#1: Given

• New value = £127,500

• Percentage decreased = 12.5%

Step#2: Applying the formula

Original Value = Final Value ÷ (1 ± Percentage ÷ 100)

Step#3: Put the values in the formula

Original Value = 127500 ÷ (1 − 12.5 ÷ 100)

Step#4: Simplify the denominator

= 1 − 12.5 ÷ 100 = 1 − 0.125

= 0.875

Step#5: The final value is

Original Value = 127500 ÷ 0.875

= 127500 × 1000 ÷ 875

= 127500000 ÷ 875 = 145714.28

The original revenue of the company was £145,714.28

Question 7:

Solution:

Step#1: Given

• New value = £4720

• Percentage increased = 18%

Step#2: Applying the formula

Original Value = Final Value ÷ (1 ± Percentage ÷ 100)

Step#3: Put the values in the formula

Original Value = 4720 ÷ (1 + 18 ÷ 100)

Step#4: Simplify the denominator

= 1 + 18 ÷ 100 = 1 + 0.18

= 1.18

Step#5: The final value is

Original Value = 4720 ÷ 1.18

= 4720 × 100 ÷ 118

= 472000 ÷ 118 = 4000

The original price of the car was £4000

Question 8:

Solution:

Step#1: Given

• New value = 4290

• Percentage decreased = 22%

Step#2: Applying the formula

Original Value = Final Value ÷ (1 ± Percentage ÷ 100)

Step#3: Put the values in the formula

Original Value = 4290 ÷ (1 − 22 ÷ 100)

Step#4: Simplify the denominator

= 1 − 22 ÷ 100 = 1 − 0.22

= 0.78

Step#5: The final value is

Original Value = 4290 ÷ 0.78

= 4290 × 100 ÷ 78

= 429000 ÷ 78 = 5500

The original number of employees in the company was 5500

Question 9:

Solution:

Step#1: Given

• New value = £1397

• Percentage increased = 27%

Step#2: Applying the formula

Original Value = Final Value ÷ (1 ± Percentage ÷ 100)

Step#3: Put the values in the formula

Original Value = 1397 ÷ (1 + 27 ÷ 100)

Step#4: Simplify the denominator

= 1 + 27 ÷ 100 = 1 + 0.27

= 1.27

Step#5: The final value is

Original Value = 1397 ÷ 1.27

= 1397 × 100 ÷ 127

= 139700 ÷ 127 = 1100

The original price of gold was £1100

Question 10:

Solution:

Step#1: Given

• New value = £315,800

• Percentage decreased = 19.5%

Step#2: Applying the formula

Original Value = Final Value ÷ (1 ± Percentage ÷ 100)

Step#3: Put the values in the formula

Original Value = 315800 ÷ (1 − 19.5 ÷ 100)

Step#4: Simplify the denominator

= 1 − 19.5 ÷ 100 = 1 − 0.195

= 0.805

Step#5: The final value is

Original Value = 315800 ÷ 0.805

= 315800 × 1000 ÷ 805

= 315800000 ÷ 805 = 392298.13

The original revenue of the company was £392,298.13